Negotiating Deficiency After a Foreclosure

If you have taken a home loan and due to some personal or financial problems, you are finding it difficult to continue making the monthly payments, then you should prepare yourself for negotiating a deficiency after the foreclosure. Once you start to default, the lender gets the right to take refuge of foreclosure whereby your property is sold off and the funds generated are used to pay off the debt.

Foreclosure and deficiency judgments

Normally, the prices of real estate increase with time. However, if the value of the property doesn't appreciate much, then the funds collected through foreclosure will be less than the amount owed by the debtor. The lender will expect the borrower to pay off the difference, and to compel him to do so, he will file a legal suit called deficiency judgment.

Deficiency judgments are potent legal weapons that are commonly used by the lenders to fork out every single penny of the debt from the defaulter. If the lender succeeds in getting the judgment, then things literally go out of hand. The best method to avert a deficiency judgment is to negotiate deficiency immediately after the foreclosure.

How to negotiate deficiency

Negotiating deficiency after a foreclosure is not an easy task. Firstly, you would have to bring the lender to the negotiating table. Secondly, you would have to convince him that your financial condition is not at all good. For this, you would have to collect and present all your bank documents, salary details, and so forth to prove that you are financially misfit to payoff the debt. Finally, you would have to make some arrangements to decrease your indebtedness. To ensure success, you would have to be overtly frank, honest, truthful and straightforward.

Benefits of hiring a negotiator for negotiating deficiency

Frequently, the lenders sell the deficiency judgments to collection agencies for a few dollars. These agencies use different kinds of inappropriate and embarrassing methods to retrieve the pending payment from the debtor. To prevent the lender from getting and selling the deficiency judgment, it is advisable to hire a proficient negotiator. A competent negotiator will use all his expertise and experience to make the lender believe that deficiency judgment is not a suitable strategy to recover the outstanding debt. Through factual data, balance sheets and comparative analysis, he will persuade the lender to reduce the unpaid debt and pardon off the differential.

Remember, negotiation is a powerful tool by which you can not only avert deficiency judgments, but you can also reduce your debt load. Hence, don't be afraid of negotiating deficiency after foreclosure.

Why not come and visit Jeremy's latest website over at Cheap Airbeds Store.com [https://cheapairbedsstore.com/] which provides plenty of information about the Queen Sized Air-mattress [https://cheapairbedsstore.com/queen-sized-air-mattress.php], including reviews and other related information that you need when looking for air beds and accessories.

Related: Negotiations Course

Free Downloads

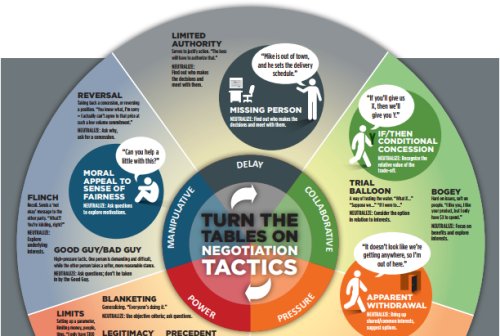

Neutralizing Negotiation Tactics

Public Negotiation Training